It seems that Donald Trump administration’s tariff policies are promoting not just Apple but other global smartphone makers as well to export from India to the US. Android phone exports from India to the US are experiencing substantial growth, alongside Apple’s iPhones, influenced by both US tariff regulations and India’s initiatives to boost exports.In the Indian smartphone manufacturing sector, whilst Samsung and Motorola have enhanced their export operations to the United States and other international markets, Apple maintains its position as the dominant smartphone exporter, particularly in shipments to the US market from India.

Surge in Android smartphone exports from India to US

- Data from market research firm Canalys quoted in an ET report shows that Motorola, owned by Lenovo, exported 1.6 million Android smartphones from India during the initial five months of 2025, with the US receiving 99% of these shipments. This marks an increase from 1 million units in 2024.

- Industry experts note that Motorola, which partners with Indian manufacturer Dixon Technologies, previously relied predominantly on China for US market supply.

- China now faces a 55% US tariff since April, whilst India incurs 26%. Although smartphones are temporarily exempt from these reciprocal tariffs, the US policy outlook remains uncertain.

- According to Canalys data in the financial daily’s report, Samsung, another significant exporter of smartphones from India to the US, delivered 945,000 units between January and May, up from 645,000 in the previous 12 months.

- The US imposes a 46% tariff on Vietnam, Samsung’s primary export base for American markets. These tariffs are currently suspended for 90 days whilst Vietnam engages in trade negotiations.

Dixon Technologies’ Managing Director Atul Lall announced during a recent earnings call that they are boosting their production capacity by 50% above existing levels for Motorola, their key client. This expansion primarily aims to fulfil increased export demands to North America, particularly the United States, considering the current geopolitical landscape.

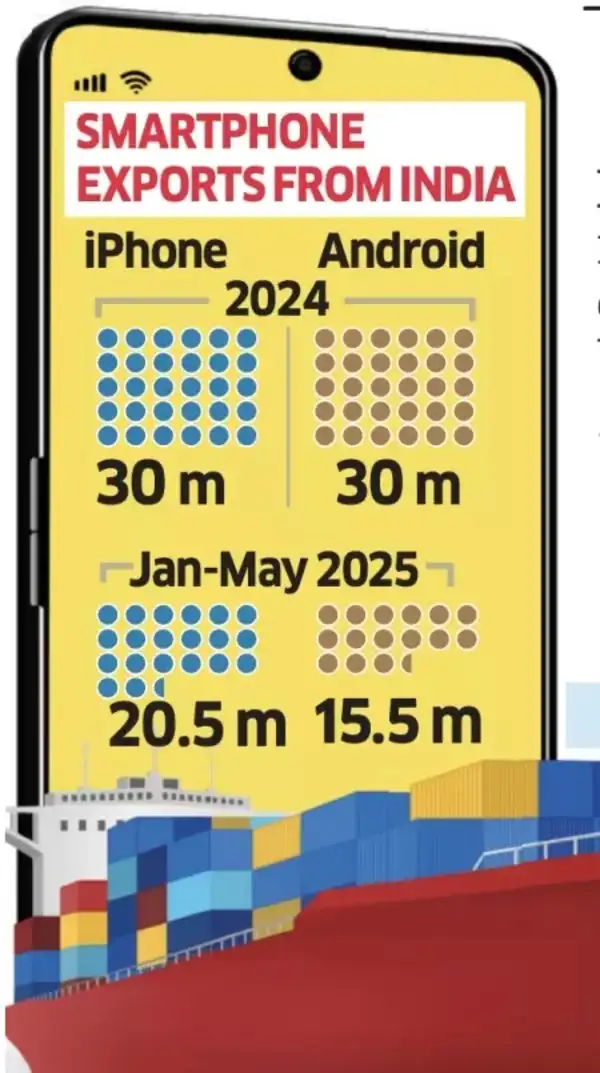

Smartphone exports from India

India’s PLI Push Bears Fruit

Driven by the government’s PLI scheme aimed at establishing India as a global manufacturing hub, smartphone manufacturers are increasing their exports to African nations and the UAE. Companies like Dixon, Samsung, and Apple’s partners Foxconn and Tata Electronics benefit from these incentives.Also Read | Reducing acute dependence, countering China’s near monopoly: India readies Rs 5,000 crore scheme for rare earth mineralsData from Canalys shows that India’s smartphone exports reached 35 million units during January-May, with Apple contributing 20.5 million units. The United States received 80% of Apple’s exported devices.In 2024, total smartphone exports amounted to 60 million units, with Apple responsible for 50% of the volume. Other significant exporters included Samsung and Motorola.Industry analysts note that manufacturers including Samsung, Motorola, Transsion, and HMD Global (Nokia’s manufacturer) are expanding their export operations from India. The PLI scheme has enhanced their global cost competitiveness, enabling them to export to markets with sufficient capacity.According to Canalys, Samsung’s production, both in-house and through Dixon, is likely to achieve or surpass its 2024 export figures, having reached nearly half its target by May 2025. The company’s exports totalled 25.3 million smartphones in 2024, with 11.4 million units already exported by May 2025.Also Read | Elon Musk bets on India: Tesla to open showrooms in July; ‘Made in China’ EV may cost more than $56,000, says reportSamsung maintains its export leadership among Android manufacturers, though its growth has plateaued due to shifting market destinations influenced by tariff uncertainties, according to Canalys analyst Sanyam Chaurasia. “Motorola is emerging as a surprise mover, nearly doubling its US-bound exports.”The Transsion group’s brands – Infinix, Tecno and iTel – have increased their export activities. Dixon secured a controlling interest in Transsion’s manufacturing operations in May 2023.Dixon’s Lall indicated strong export commitments to African markets, where Transsion commands over 80% market share. The company is exploring possibilities to export Google Pixel phones manufactured at their Indian facilities.Vivo, the leading smartphone brand in India’s market and of Chinese origin, has begun modest export operations from India. The company shipped approximately 350,000 devices in 2024, with 250,000 units already exported until May this year, primarily to Thailand and Malaysia.Following its strategic manufacturing collaboration with Dixon and relocation to larger production facilities, Vivo is expected to enhance its export volumes starting this year.Also Read | Advantage India! As West moves away from China & Bangladesh, India’s apparel exports see big growth; $120 billion US market biggest opportunity