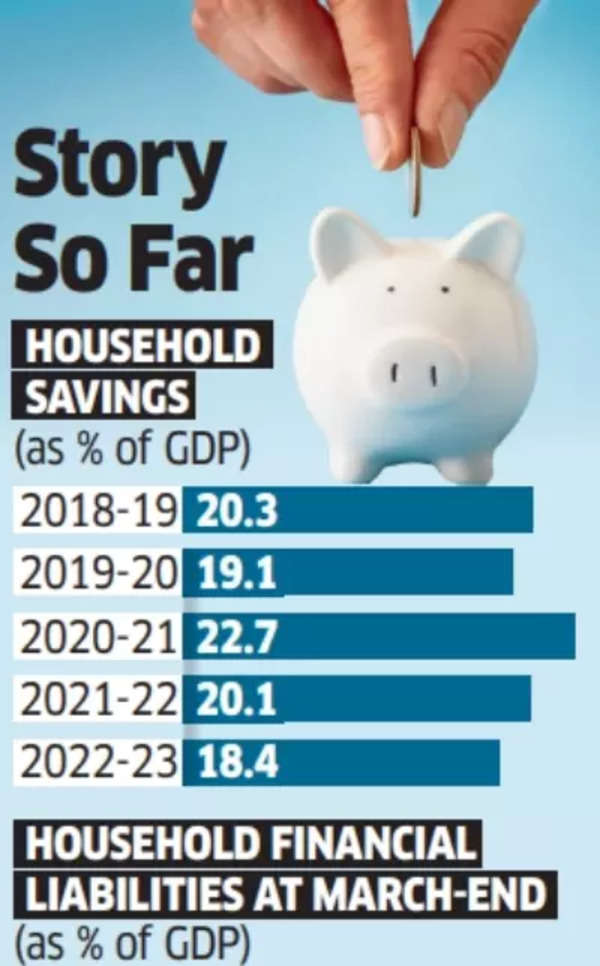

The Finance Ministry has told the Parliament about the risks associated with households moving their deposits from banks to market-linked financial instruments seeking better returns. This shift could expose families to substantial market risks, potentially leading to monetary losses during periods of market instability, particularly due to limited risk assessment capabilities and financial awareness, the Finance Ministry has said.

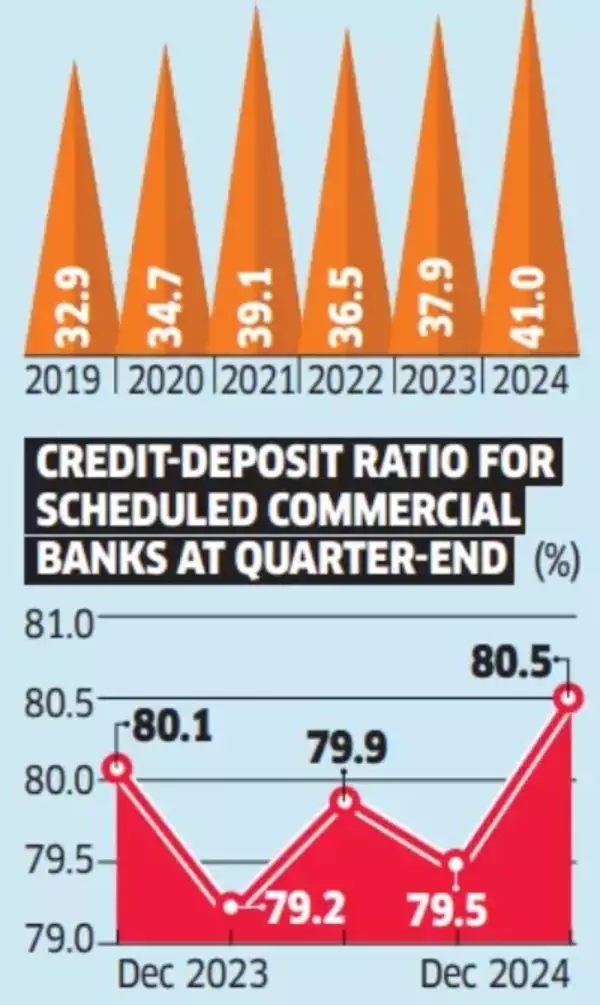

In its written response to the parliamentary standing committee regarding demand for grants, the Department of Financial Services noted that reduced financial savings create challenges for banks’ liquidity management. The department further explained that when households withdraw their savings, banks lose access to low-cost funding sources, consequently increasing their funding expenses, according to an ET report.

The committee presented its report in Parliament on Wednesday, recommending several measures. These included taking pre-emptive steps to address liquidity issues, improving customer engagement particularly in underserved regions, and adopting technological solutions to enhance operational efficiency. These measures aim to help banks counter the effects of declining CASA (current account savings account) ratios.

Regarding the budget’s proposal for complete foreign direct investment (FDI) in insurance, the committee emphasised implementing protective measures to address several concerns. These include managing profit repatriation to foreign countries, preserving decision-making authority of domestic companies, and protecting employment amidst potential automation. The committee also raised concerns about the possibility of focusing solely on profitable policies whilst neglecting rural areas and economically disadvantaged sections. They advised that these challenges in India’s insurance sector should be handled “adequately and scrupulously”.

Credit Deposit Ratio

The committee observed a significant rise in complaints under the Reserve Bank of India’s Integrated Ombudsman Scheme, with a compound growth of nearly 50% over two years, reaching approximately 934,000 in 2023-24. They recommended establishing systems to resolve grievances across multiple sectors.

The committee stressed the importance of maintaining active Jan Dhan accounts and preventing dormancy or fraud. They suggested implementing thorough verification processes and regular monitoring of account activities.

“Discrepancies should be thoroughly investigated and accounts that are inactive for prolonged periods or found to be fraudulent should be deactivated,” it said.