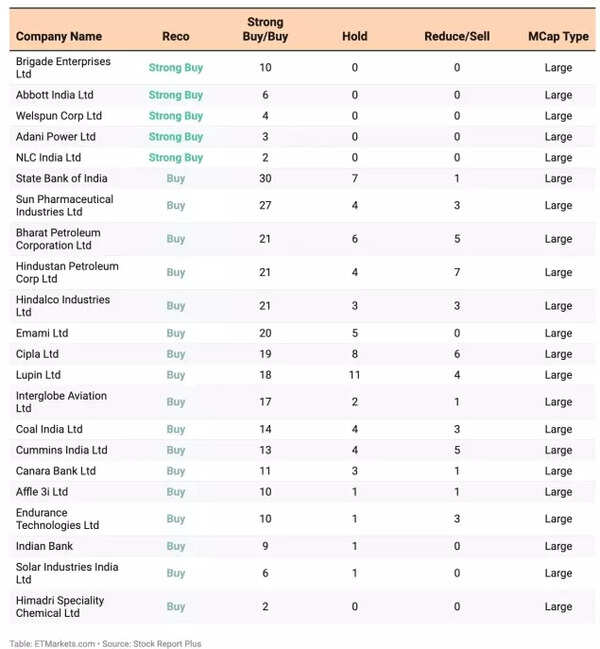

For optimal investment choices, here is a curated list of companies that have received top ratings from Stock Reports Plus, combined with “Strong Buy/Buy” recommendations according to the Institutional Brokers’ Estimate System (IBES).The selection of weekly recommendations, compiled by ET, aims at delivering practical insights for organisations demonstrating robust financial health.According to the ET report, Stock Reports Plus, utilising Refinitiv’s expertise, conducts comprehensive assessments of over 4,000 listed companies. The analysis encompasses detailed corporate evaluation, alongside compilation of analysts’ predictions and trend examination for individual components. The platform calculates an aggregate score through quantitative evaluation of five crucial investment parameters – earnings, fundamentals, relative valuation, risk and price momentum.Each parameter carries uniform importance, with the least volatile shares receiving a maximum score of 10.The Price Momentum calculation in the weekly analysis combines two technical indicators: a 70% weighting for Relative Strength and 30% for seasonality patterns. The overall rating incorporates one-month, three-month and six-month RSI values, whilst the seasonality component analyses ten-year historical price trends for both the company and industry across the current and subsequent two months.Each element receives ratings from 1 to 10, with 10 representing optimal performance. Subsequently, the overall stock perspective is determined by calculating a simple average of the normally distributed component ratings.Ratings between 8 and 10 indicate a favourable outlook, whilst 4 to 7 suggests a balanced view, and 1 to 3 reflects unfavourable prospects. Stocks achieving a perfect average of 10 without analyst recommendations are excluded. Weekly score reassessments occur, whilst the report’s data points undergo daily updates.The compilation features organisations that achieved a perfect average score of 10 as of June 24, 2025. The arrangement follows the quantity of analysts who have designated these stocks as “Strong Buy/Buy”. The compilation follows.

Weekly Stock Picks

The earnings assessment considers three primary factors – Earnings Surprises, Estimate Revisions, and Recommendation Changes. The variance between a company’s actual earnings and analysts’ consensus expectations results in either a “Positive” or “Negative Surprise”. The evaluation incorporates surprises observed across four consecutive quarters.Estimate Revisions reflect the quantity of upward and downward adjustments in a company’s earnings per share by analysts, along with the mean percentage variation of these modifications.Financial fundamentals analysis encompasses profitability assessment, debt evaluation, earnings quality review and dividend pattern examination. These elements carry identical weightage in the assessment framework, with ratings assigned from 1 to 10.The valuation methodology incorporates three key metrics: price-to-sales ratio contributing 50%, whilst trailing and forward price-to-earnings ratios each account for 25%. These parameters are benchmarked against broader market indices, sector averages and the organisation’s historical five-year performance.The risk assessment framework considers both extended five-year and brief 90-day share performance indicators, including price fluctuations, return measurements, beta coefficients and correlation values. (Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)